Historic Tax Credits

New Markets Tax Credits

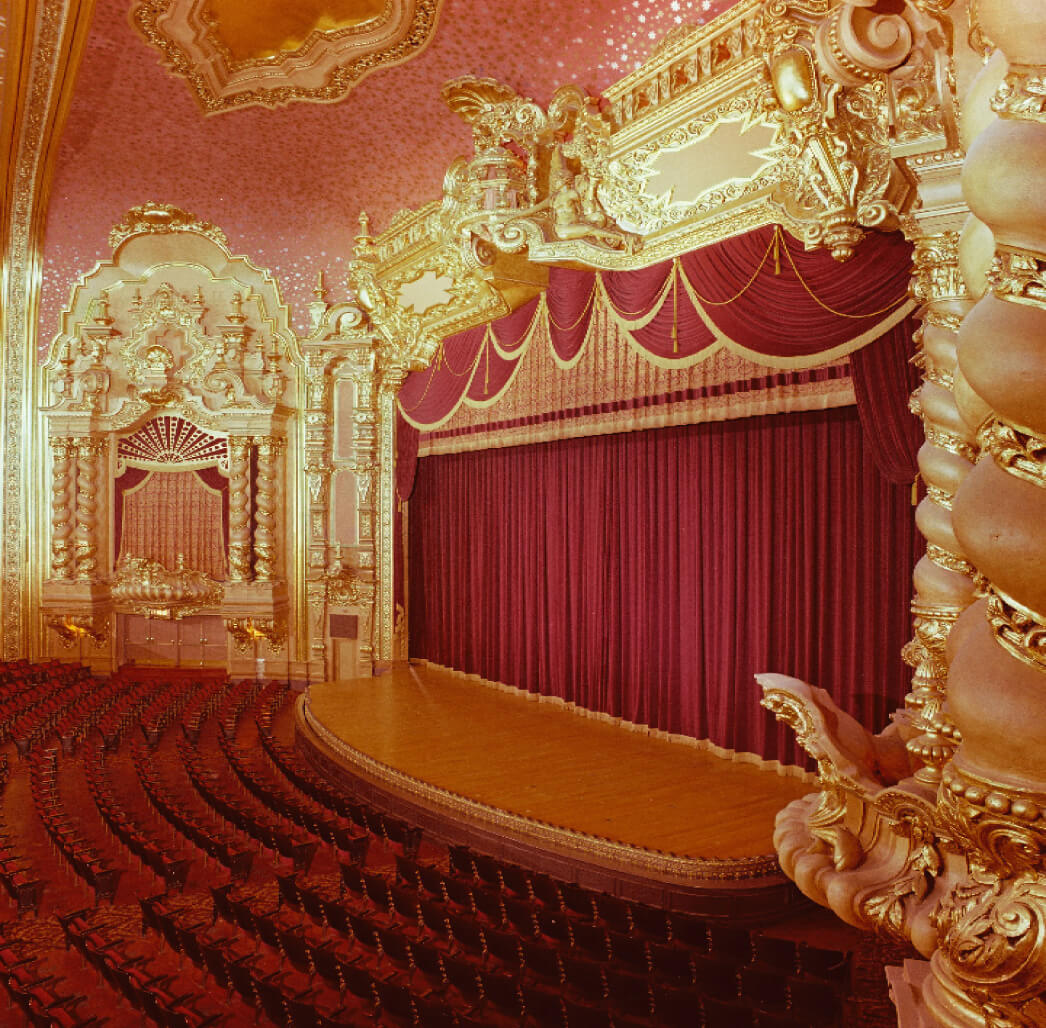

The Stanley Theatre

Plymouth Soundings provided Tax Credit and other financial coordination and accounting assistance for this $35MM major rehabilitation project of an historic theatre/performing arts center. Tax Credits financing required three separate closings, with $6.5MM of Federal and State Historic Tax Credits and $4.4MM of Federal Historic Tax Credits. The project involved multiple investors, multiple lending institutions, and complex timing issues.

Plymouth Soundings provided coordination and reports to execute the draws on the various funding sources during construction and asset capitalization. Plymouth Soundings also prepared final cost certification analysis and documents for the syndication accountants and prepared equity installment requests from investors.

During the compliance period, Plymouth Soundings worked closely with the Stanley Finance staff as they learned the protocols for cash and transaction management across multiple entities, each with unique roles, to continue to comply with the tax credit requirements.

Plymouth Sounding guided client through all the compliance reporting requirements on an ongoing basis for the multiple investors and the New Markets Allocatee as well as assisted in wind down after compliance period.

The Stanley Theatre

Utica, NY